As a green card holder who lives and works in the US, you might be wondering: am I eligible to receive Social Security benefits? The short answer is yes, but to answer in full would take understanding a complex set of eligibility requirements, work history rules, and international agreements.

That’s all right; by 2025, the complete guide would have been prepared for all that covers Green Card Holder Social Security Benefits: who qualifies, how much eligibility there is, on what day the payment actually starts, and how much international residency affects your benefits.

What Is a Green Card?

A Green Card is very much officially called a Permanent Resident Card. It allows foreign nationals to legally reside and work permanently in the United States. An individual who carries a green card is known as a lawful permanent resident (LPR). In fact, even for taxation, green card holders would be treated at par with citizens of the U.S., including Social Security contributions.

Do Green Card Holders Pay Into Social Security?

Yes. Green card holders who are employed in the United States must pay FICA taxes, Social Security and Medicare taxes. Just as U.S. citizens do. This enables them to be eligible for future Social Security benefits based upon the amount paid in Social Security contributions.

| Tax Type | Percentage Paid | Who Pays |

|---|---|---|

| Social Security | 6.2% (on wages up to $168,600 in 2025) | Both employee and employer |

| Medicare | 1.45% (no income limit) | Both employee and employer |

Do Green Card Holders Get Social Security Benefits?

Yes, Green Card Holders Get Social Security Benefits ONLY IF:

- Have earned 40 work credits, essentially 10 years of work;

- 2. At 62 will commence claims for retirement benefits;

- 3. Legally residing in the U.S. or a country that has a Social Security Totalization Agreement with the U.S.; and

- 4. Meets other SSA requirements like a Social Security Number (SSN), non-removability, and valid immigration status.

Decoding the Work Credits Influence on the Eligibility

Social Security retirement benefits come your way only if you earned at least 40 work credits from covered employment. You may earn up to 4 work credits each year, and for the year 2025, one credit is awarded for every $1,730 earned.

| Year | Earnings Needed for One Credit | Max Credits Per Year |

|---|---|---|

| 2025 | $1,730 | 4 |

For example, you will earn the maximum 4 credits for working in 2025 if you have earned at least $6,920 that year.

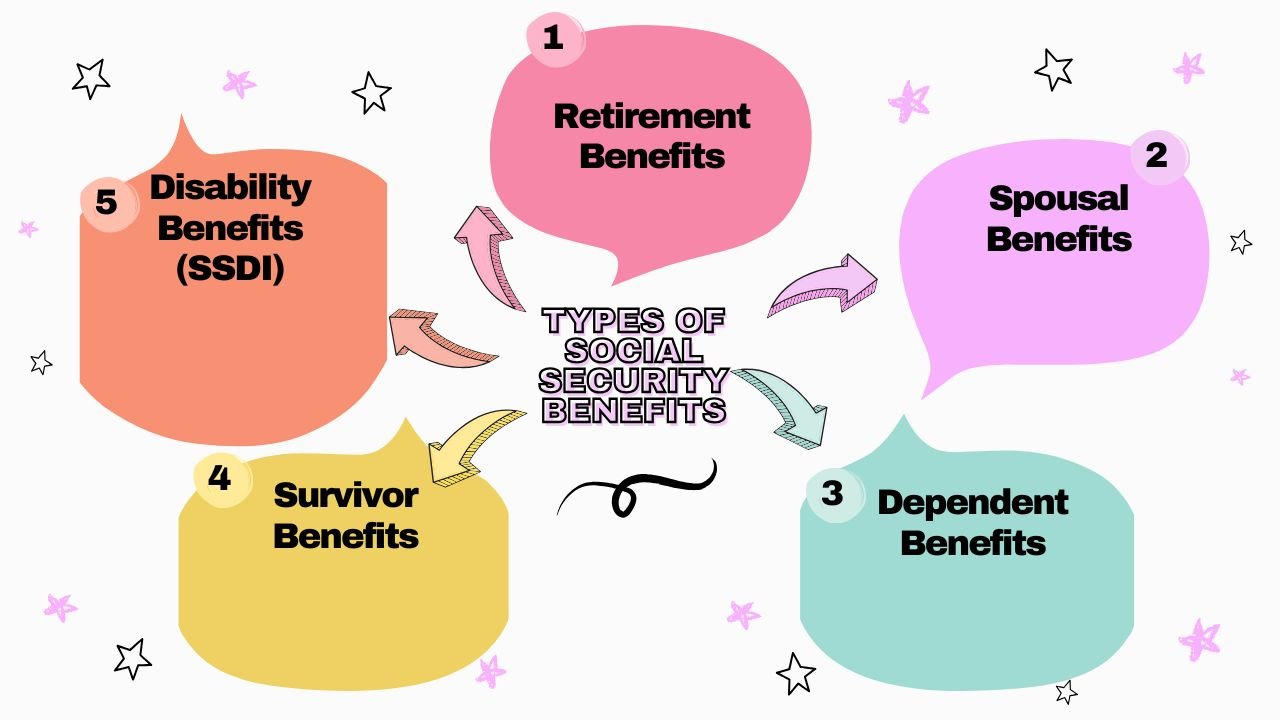

Types of Social Security Benefits Available for Green Card Holders

There are various types of benefits for green card holders according to their work history, age, disabilities, and the family situation.

| Benefit Type | Eligibility Criteria |

|---|---|

| Retirement Benefits | 40 work credits, age 62+ |

| Disability Benefits (SSDI) | Must meet SSA’s definition of disability + sufficient work credits |

| Survivor Benefits | If the deceased spouse worked and paid into Social Security |

| Spousal Benefits | If spouse qualifies for benefits |

| Dependent Benefits | Children may receive benefits if a parent is eligible |

Total and International Agreements:

For the green card holders who have worked in the U.S. as well as in any other country, Totalization Agreements permit the account of work history in both countries for eligibility for benefits.

Countries With U.S. Totalization Agreements (selected):

- Canada

- United Kingdom

- Germany

- India

- South Korea

- Japan

- Australia

They’re usually referred to as double taxation treaties, and even if your work history is disjointed, they nonetheless make you eligible for benefits.

What If You Leave the United States?

Even if green card holders are then at an overseas location, they can still receive Social Security benefits. However, conditions apply:

The country must not be restricted by SSA (e.g. North Korea, Cuba, and others).

You should fulfill the conditions of alien nonpayment.

Your physical foreign residence address and bank account details must be documented.

| Country Status | Benefit Eligibility |

|---|---|

| Country with Totalization Agreement | Yes, under agreement |

| Country with no agreement | Possibly, but limited |

| Restricted country (e.g., North Korea) | No benefits paid |

Green Card Holder Abroad Payment Methods

If you are eligible for benefits while residing in another country you may receive payments by:

- Direct deposit to a foreign bank account (for approved countries)

- International Direct Deposit (IDD)

- U.S. bank account (if you maintain one)

- How Much Will a Green Card Holder Receive?

- Social Security benefits are based on individual lifetime earnings. The more one earns and contributes, the higher one’s monthly benefit will be.

2025 Average Monthly Benefit Estimates:

| Benefit Type | Estimated Amount |

|---|---|

| Retirement (individual) | $1,905 |

| Disabled Worker | $1,537 |

| Spouse of Worker | $902 |

| Surviving Spouse | $1,710 |

Note that those are estimates, on average. Actual figures will depend on actual earnings and the age at which benefits are claimed.

The following steps will guide applying for Social Security by green card holders:

- Login to the my Social Security online account or visit an SSA office.

- Submit green card, Social Security card, and record of work history documents.

- Select type of benefit (retirement, disability, etc.).

- Apply online, by telephone, or in person.

- Wait for approval and the benefits start date.

Timeline: When Will Benefits Start?

| When You Apply | When Payments Begin |

|---|---|

| Age 62 (early retirement) | Reduced benefit starts after ~3 months |

| Full retirement age (67 for most) | Full benefit starts within 2–3 months |

| Disability claim | Approval may take 3–6 months; payments retroactive after 5-month wait |

Critical Tips for the Year 2025

Check your benefit estimates using the SSA.gov tools.

File all your tax returns even if you do not owe taxes, to keep your records clear.

Think about delaying retirement to further enhance your OP monthly benefit.

Know any dual taxation rules if you have foreign income.

If your case is complex, consult a Social Security attorney or specialist.

Common Mistakes Green Card Holders Should Avoid

- Not earning 40 work credits before retirement.

- Assuming citizenship is required.- not true; legal residency is enough.

- Not checking Totalization eligibility on a split work history.

- Not reporting foreign income or a foreign address if residing abroad.

- Taking benefits too soon means enjoying reduced compensation forever.

In conclusion

The road to obtaining Social Security benefits under the jurisdiction of a green card in 2025 is made clear-there are conditions. With likely planning, a consistent work history, and legal residency, retirement, disability, and survivor benefits are put in place for you like any other U.S. citizen.

Understanding how the system works ensures you make the best decisions for your future. Don’t wait until you’re near retirement age; start reviewing your work credits and benefit estimates along with your international residency options today.

FAQS:

Can permanent resident aliens obtain Social Security retirement benefits?

Yes, if they have 40 work credits (approximately 10 years of work experience) under their belt in the U.S.

Must a green card holder become a U.S. citizen in order to receive benefits?

No. All lawful permanent residents can qualify for benefits meeting certain work and residency requirements.

Can I receive benefits if I live outside the U.S.?

Yes, but only if you live in an approved country and meet any additional SSA requirements.

Can a green card holder avail of SSI (Supplemental Security Income)?

Under general circumstances, no. SSI is available only to certain non-citizens, and has other stringent restrictions in terms of qualification.